The Pitch

With a trailing Price to Earnings Ratio of 330.32 and a forecast Forward Price to Earnings Ratio of 477.69 is Netflix (NFLX) one of the most overvalued stocks on the S&P 500?

The Thesis

I love Netflix, I have been a subscriber for some time now, but I don't believe I'm necessarily loyal to the brand. I believe the right content and pricing from a competitor could easily lure me away, and this concerns me as an investor. The ease at which I can switch to a different provider is brilliant for me as a customer, and perhaps this liberty they have gifted us is a key reason a lot of people choose to subscribe, but could it ultimately be its downfall in such a crowded market consisting of companies such as Comcast (CMCSA), 21st Century Fox (FOXA), and Amazon (AMZN)?

An addition to the list of competitors could also be Apple. Despite it being reported recently that Apple (APPL) has postponed their live streaming plans, I can't help but feel it is inevitable that in the near future we will see it finally launched in some form.

Apple has the cash to fund such a project and the allure to attract the talent necessary to make a success of it. I don't necessarily believe Apple will get into content creation, but rather that it is more likely to be in the same style of the Apple Music offering. This may not actually be too detrimental to Netflix though as Apple often go after the premium market which is perhaps more likely to hit cable TV providers hardest. Since Apple Music's release Spotify, who I think of as the Netflix of the music streaming world, appear to have still grown its user-base. Some say that Apple waited too long to get into music streaming, and perhaps the same will be said for TV streaming if they do.

My main concern with Netflix is that I believe we are currently pricing in anticipated growth upwards of ten years ahead in an incredibly unpredictable industry. Although this is relatively normal behavior for growth stocks, I fear investors could be overreaching here which has led to the 150% gain year to date.

The Future

Were we to fast forward ten years to a hypothetical maturing market what would I be wanting to see to justify the price today?

Well let's say for instance that the current industry average PE Ratio of 34 is where we want Netflix to be at in 10 years. This means that it would have to grow earnings, currently 38 cents per diluted share, by a CAGR of 25.53% for 10 years to $3.65 just for shareholders to not lose money.

Historically, studies have shown that the S&P 500 returns 7% per year on average, so why would we settle for a zero percent return when we could just invest in an index fund? We would not. So now let's factor in some shareholder returns into the equation too and see where that leaves us.

If we're happy with a return of 7% per year, the share price would have to almost double to $244.32 in these ten years (excluding any changes to shares outstanding). With a PE Ratio of 34 this means the Company would have to have net income of $3.071 billion per year, which equates to an earnings CAGR of 34.32% over the ten years, and diluted earnings per share of $7.19.

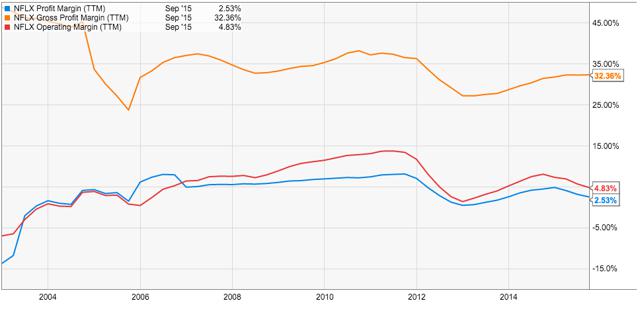

As you can see on the chart below the Company's profit margin is on the low side. However, as it matures I would expect to see improvements in margins that could support increased EPS growth.

Source: Ycharts

If the profit margin could improve to around 15% then Netflix would need to achieve revenue of $20.47 billion in 2025 which equates to a CAGR of 12.3%. This sounds reasonably achievable, but is heavily dependent on them being a key player in streaming still, the service being relevant, and the Company being able to reduce operating expenses substantially. Were they only able to improve the profit margin to 7.5% then within this scenario we would need revenue of $40.9 billion in the tenth year - a CAGR of 20.3%.

The Subscribers

As of Q3 2015 Netflix has 50.65 million paid subscribers and is earning $1.223 billion of revenue from them quarterly. Within the Q3 Letter to Shareholders the Company forecasted revenue of $1.667 billion from 70.42 million subscribers. This leaves us with estimated annual revenue of approximately $5.7 billion.

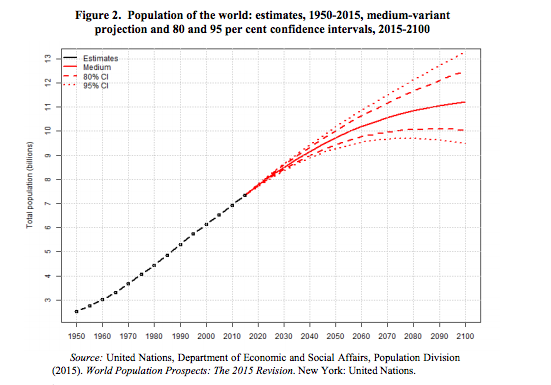

To reach the desired revenue from the scenario above with a profit margin of 15% Netflix would need around 200 million subscribers if we allow for moderate price increases during this period. This means Netflix would have to achieve a subscriber CAGR of 14.83% over the ten years from Q3's figures. Incidentally, 200 million people would be about 2.5% of the 8.1 billion world population in 2025 as estimated by the United Nations. Whether that is a bit on the ambitious side is for investors to decide.

If the profit margin was only 7.5% then the Company would need approximately 410 million subscribers, around 5% of the world population, to support the growth.

The (not so) Final Word

I think Netflix is a great company, making fantastic content, and providing a flawless service and I can fully understand why investors may be happy to invest now even with a high PE Ratio. But I am unsure whether they can produce the shareholder returns that I would be requiring over the next ten years. I'm also doubtful that we can suitably predict that far ahead for the future of the industry which means I would rather invest elsewhere at this point.

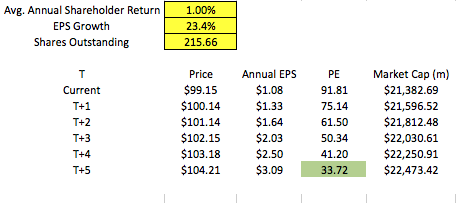

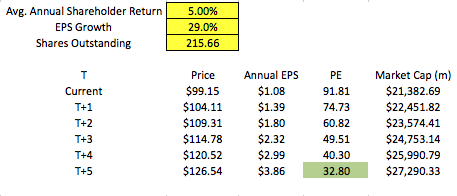

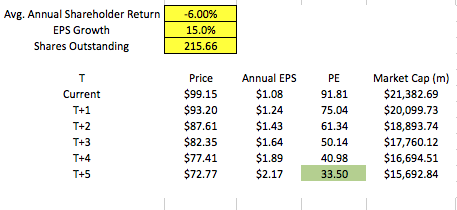

I feel that the growth required to achieve acceptable shareholder returns is out of reach and investors could jump ship in search of alpha elsewhere. I would not be surprised to see the stock drop to below the $100 level in the near term.

I see the fair value today as being around $63 which equates to a PE Ratio of 167. I doubt very much that the stock would drop to this level, but if it did I would be buying as much as I could get hold of. For now I'll be targeting a drop to $100, and we'll see where things go from there.

The (final) Final Word

I realise that a PE Ratio is not necessarily the best way to value a stock at this stage of its growth. Its use in this analysis is used as a reference to a future (mature) Netflix, and if it can complete the transition and still produce good shareholder returns.